Healthcare Industry Survey Reveals Rising Optimism Despite Persistent Concerns

February 27, 2025

Our 2025 survey of leaders from health plans, health systems, self-funded employers, and innovative solution providers reflects optimism about clinical innovation and emerging AI use cases, balanced against substantial concerns about costs, payment models, and political dynamics.

In 2024, generative artificial intelligence (AI), personalized medicine, snowballing healthcare costs, and provider consolidation proved to be defining forces in the healthcare industry. In the aftermath of the general election, TT Capital Partners (TTCP) and World 50 Accelerator, formerly Employer Health Innovation Roundtable, polled dozens of leaders within the largest and most innovative health plans, health systems, and self-funded employers, as well as senior leaders from innovative solution providers, to capture a snapshot of their feelings on the future of healthcare. The results were illuminating, and notable shifts were apparent from 2024’s survey.

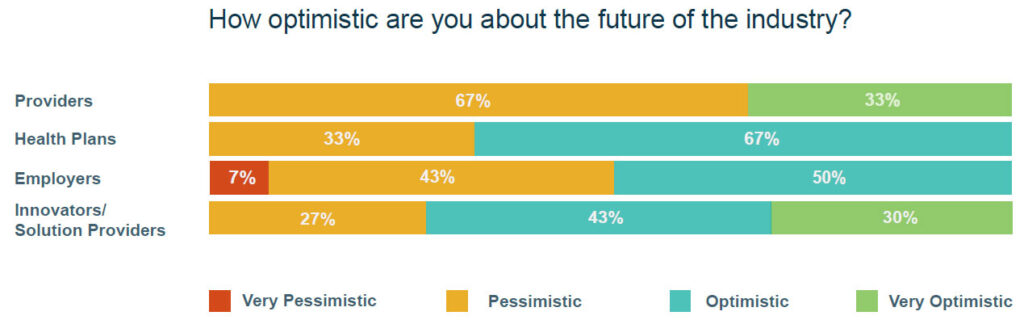

When asked how optimistic they feel about the future of healthcare over the next three years, employers were fairly evenly split, with an average score of 2.43 (2.5 being neutral on a scale ranging from 1 to 4). This sentiment remained steady from 2023.

Both health plans and providers were more optimistic overall than employers, with an average score of 2.67, and slightly more optimistic than they were in 2023 (2.5). Innovators were the most optimistic of the four groups surveyed in both 2024 and 2023, scoring 3.03 in both years. However, although innovators remain largely optimistic, the percentage of innovators who reported feeling optimistic dropped by 12%, and the percentage who reported feeling pessimistic grew 11%.

A common theme across employers, health plans, and providers is optimism about technology and innovation improving care and back-end functions. However, there is also widespread concern about rising costs in healthcare and the changing political environment.

Health Plans: Cautious Optimism Amid Challenges

Still, there are big challenges holding back progress. Health plans echoed employers’ deep concerns about rising healthcare costs, along with an aging population and workforce shortages, which can threaten the quality and availability of care. Most health plans also struggle to embrace innovation, hampered by legacy systems, complex hierarchies, and thin operating margins, slowing the adoption of new technology and innovative solutions.

In 2024, health plans reported more confidence in the future of healthcare than in 2023, with their sentiment score rising from 2.50 to 2.67 out of 4, and with 67% of respondents feeling optimistic. The health plans were especially hopeful about advancements in technology, particularly the potential of AI to solve key challenges in healthcare. They see AI as a way to make care delivery more efficient, improve access to services, and simplify administrative tasks. The slow but steady move toward value-based care models is another reason for their optimism, signaling a shift to more sustainable ways of delivering care.

“While I worry about increased healthcare use as the population ages and the impact of supply due to a decrease in the working age population, I’m also excited about the potential to decrease administrative costs through the use of AI.”

— Health Plan Leader

To tackle these issues, some health plans are focusing on controlling rising claims costs and improving how they engage with their members. While they recognize the complexity of using AI, they also view it as a crucial tool for increasing efficiency and cutting administrative costs. This balanced approach shows a clear understanding of both the opportunities and obstacles for AI in healthcare.

Despite the challenges, health plans see real potential for progress through technology and reforms in how care is delivered. One health plan leader commented, “While I worry about increased healthcare use as the population ages and the impact of supply due to a decrease in the working age population, I’m also excited about the potential to decrease administrative costs through the use of AI.”

Ryan Engle, a partner at TT Capital Partners, said the survey findings echo feedback that he hears regularly from leaders in the industry. “As the early applications of AI start to return value, measurably reducing waste, creating efficiencies, and improving care, we’re seeing signs of optimism from health care plans that recognize the tangible impact on the quality and cost of care.”

“As the early applications of AI start to return value, measurably reducing waste, creating efficiencies, and improving care, we’re seeing signs of optimism from health care plans that recognize the tangible impact on the quality and cost of care.”

— Ryan Engle, Partner, TT Capital Partners

Providers and Health Systems: Operational Gains Enable Investment in Innovation

While the provider respondent pool was limited in size for the 2025 survey, participants reported more positive sentiment at 2.67, up from 2.33 in 2024, matching broader industry trends pointing to growing optimism among providers. For example, Kaufman Hall reported that hospitals and health systems ended 2024 with stabilized financial and operational performance, marking a major improvement from previous years. And a December Fitch Ratings report noted that “many providers have seen volumes rebound to above pre-pandemic levels,” with particularly strong growth in high-demand markets.

“Our health system members tell me that they are starting to shift from simply surviving to looking ahead and strategically investing in technology that can truly improve care and risk management.”

— Shelby Barker, Group Director, World 50 Accelerator

This stronger financial foundation seems to be driving providers’ optimism about adopting new innovations and technologies. Health systems are especially excited about emerging solutions that could help them better manage risk, improve care delivery models, and achieve better outcomes for patients. The stabilization of key metrics, such as operating margins and outpatient revenue, is giving health systems more room to invest in transformative technologies.

“Our health system members tell me that they are starting to shift from simply surviving to looking ahead and strategically investing in technology that can truly improve care and risk management,” said Shelby Barker, group director, World 50 Accelerator. “Investing in new tools is the easy part; the hard part is making them work seamlessly in the daily flow of patient care. The systems that succeed will be those that commit to making innovation stick.”

“The speed of new technology in healthcare is both exciting and scary. The potential to transform care delivery and outcomes is incredible, but the speed of change demands that we implement these advances thoughtfully and responsibly.”

— Provider/Health System Leader

At the same time, providers are realistic about the challenges of implementing technology. One employer commented, “The speed of new technology in healthcare is both exciting and scary. The potential to transform care delivery and outcomes is incredible, but the speed of change demands that we implement these advances thoughtfully and responsibly.”

Providers have specific concerns about barriers to innovation adoption and relevant regulatory hurdles. This balanced perspective shows that while providers are excited for the potential in new technology, they understand that true transformation will require careful planning and navigation of both internal challenges and external regulations.

Employers: Balancing Technology, Innovation, and Cost

As we saw in the 2024 survey, employers reported being evenly split in their feelings about the future of healthcare, with 50% feeling optimistic, 43% feeling pessimistic, and 7% feeling very pessimistic. Over the past year, AI became more prominent in healthcare, and employers referenced specific use cases, like strengthening patient/provider relationships, promoting engagement, and reducing administrative loads, as reasons for optimism. These comments reflect the growing maturity of AI in the market, in contrast to the more general references to AI made in the 2024 survey.

Broadly, technology and innovation were clear drivers of employers’ optimism, being referenced by 93% of respondents. In addition to AI, respondents expressed excitement about personalized medicine and genomics becoming more accessible and clinically robust. One employer commented on “the potential use of AI to improve provider/patient relationships and more quickly and accurately complete tasks like claims reporting and reviewing scans or lab work.” In line with this focus on care and the care relationship, a handful of employers called out strengthening primary care as a reason for excitement.

This optimism was counterbalanced by concerns about rising costs, industry inertia, political dynamics, labor shortages, and access to care. Cost concerns were unsurprisingly the most widespread, with 72% of respondents mentioning this challenge. One expressed concern over “rising costs and the role that employers can afford to play in this space in future years,” demonstrating the link between buying power and industry influence that comes at an increasingly high cost. Employers play a key role in introducing, funding, and scaling innovation within healthcare, so if employers find themselves increasingly priced out, the healthcare industry could experience a dramatic ripple effect.

Employers similarly expressed concern about the entrenched status quo of the U.S. healthcare system as a whole, as well as disproportionately powerful players like the “Big Three” pharmacy benefit managers (PBMs). Employers recognize the urgent need for change in the industry but also face significant inertia internally and from outside players when trying to make substantive changes. The government, in particular the new administration, has the potential to influence this inertia. Several employer respondents voiced concerns about the new administration rolling back progressive policies such as the Affordable Care Act (ACA). However, the government arguably also holds significant influence over enabling employers’ goals such as cost containment and promoting preventive and primary care. Actions and impacts from the new administration are difficult to anticipate, so employers will need to be ready to react in real time.

Employers also recognize the downstream effects of labor shortages, which drive increases in the cost of care and access challenges for their employees. These shortages are expected to persist for at least three years, so employers and other industry stakeholders will need to seek creative solutions to ensure care needs are met.

“Our community of nearly 100 employers share an optimistic vision for transforming healthcare,” said Katie Tenney, healthcare practice leader, World Fifty Accelerator. “Through collaboration and shared learning, our members work to be responsible stewards of healthcare dollars while providing great benefits to their employees; yet they recognize that true transformation will require action from the broader industry. The future of healthcare hinges on balancing innovation with cost containment and overcoming systemic barriers to change.”

Innovators/Solution Providers: Sustained Optimism with Growing Pragmatism

Healthcare solution providers remain the most optimistic group in the survey pool, with a score of 3.03 out of 4. This optimism is supported by 61% of respondents reporting that their company is growing. However, their outlook has become more nuanced compared to last year. In 2023, 85% of innovators expressed optimism, but the 2024 results show a more contrasting view. Innovator enthusiasm for new opportunities is now tempered by a deeper understanding of the challenges involved in making those opportunities a reality.

Innovators’ optimistic attitude persisted in the 2024 survey, with 30% feeling very optimistic about the future of healthcare over the next three years, and another 43% feeling optimistic. Several positive trends in the market fuel this steady optimism. Innovators are encouraged by progress in preventive care and personal health management, supported by the new administration’s policies. Like employers, innovators were confident about advances in AI and genomics, which have accelerated the adoption of personalized medicine. Many respondents also highlighted improvements with healthcare transparency in data sharing and pharmacy benefits, along with better access to care. One respondent described how they envision these advances converging: “The future of healthcare excites me because of its shift toward technology-driven, personalized, and proactive care. Advances like AI, remote monitoring, and wearable devices enable real-time interventions and better outcomes. Personalized medicine, predictive analytics, and holistic care approaches address not only physical but also mental and social health. The rise of virtual-first care improves accessibility and equity, while value-based care focuses on better outcomes over service volume. Empowered patients, equipped with digital tools, actively engage in their health.”

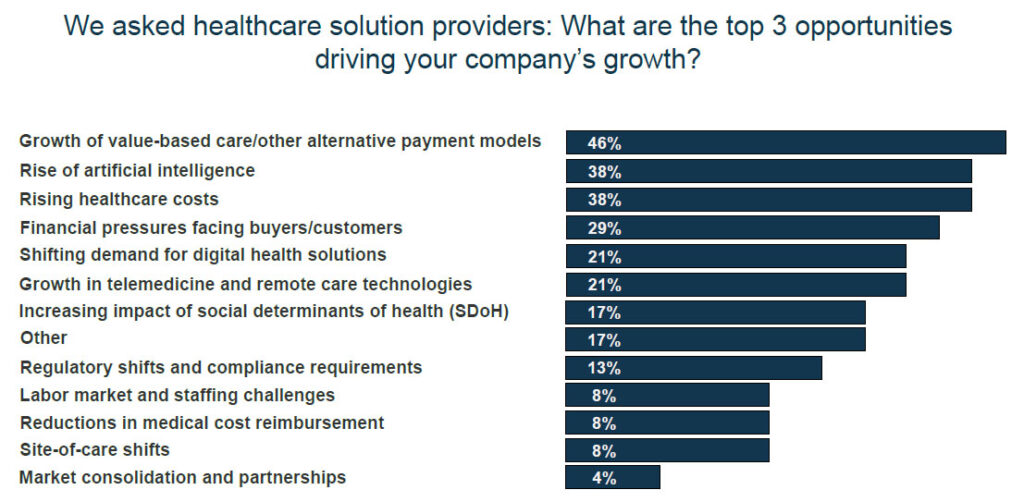

In a shift from last year, the 2025 survey reflects a growing awareness among solution providers of systemic barriers to progress. As one respondent pointed out, “The fact that we still use the fax machine means change is a Sisyphean task.” These obstacles are especially evident in the growth of value-based care (VBC) and alternative payment models, which 46% of innovators identify as key drivers of growth. While rising healthcare costs create market opportunities, with 38% of respondents citing this as driving growth, these same financial pressures present a double-edged sword, as 43% of innovators identify them as potential threats to growth.

Innovators’ level of optimism correlated with the end markets they sell to. Innovators selling to employers were the most optimistic, with a score of 3.38, and those selling to health systems the least, at 2.50. Innovators also reported varying forces both driving and impeding their companies’ growth. Those selling to employers identified rising healthcare costs (62%) as the strongest growth driver, indicating that innovators are actively seeking to address employers’ top concern. In line with 2024 trends, innovators selling to health systems highlighted financial pressures on buyers as their most prominent (50%) threat to growth.

Methodology

The survey responses were gathered from mid-November through early December 2024. Responses were anonymous, and respondents were asked to classify themselves as an employer, payer, provider, payer/provider, or solution provider. Respondent quotes were gathered via the survey and have been lightly edited for clarity and conciseness.

TAGS

Market Insights