Healthcare Industry Perspectives

Double-Edged Sword: Excitement About Healthcare Innovation Tempered by Concerns over Rising Costs

March 1, 2024

In December, TT Capital Partners (TTCP) and Health Plan Innovation Roundtable (HPIR), a World 50 Group company, captured the pulse of dozens of leaders in the healthcare payor, provider, and employer space, asking one simple question: “When you think about the future of healthcare over the next three years, how do you feel?”

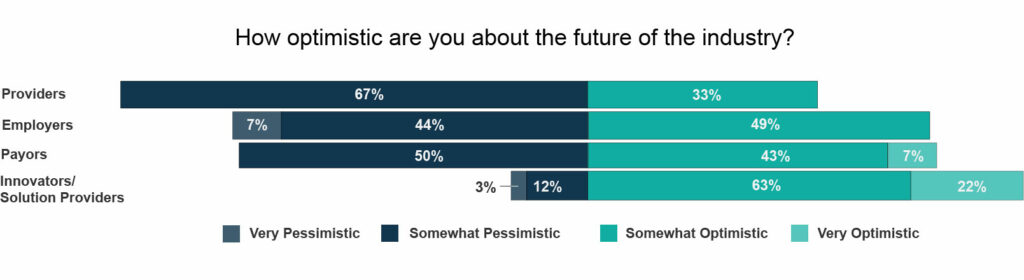

The results: About half of payors and employers are optimistic about the future of the industry, while two-thirds of providers say they are more cautious. By comparison, nearly 85% of early and growth-stage healthcare innovators reported being either somewhat or very optimistic about the future of healthcare during a similar survey conducted last summer.

The overarching theme is clear — many in the industry are balancing their excitement for healthcare innovation with concern about an unsustainable increase in costs.

Healthcare Plans: Guarded Optimism

Of the three groups surveyed, healthcare payors are the most optimistic about the future of the industry. Half of respondents say they are optimistic, including 7% who feel very optimistic. More specifically, respondents cite the potential of AI and disruptive healthcare models like value-based care as reasons for their excitement. “I’m excited about the potential for AI and other technologies to address healthcare cost and access challenges, as well as underlying care delivery inefficiencies,” notes one survey respondent.

Conversely, the main worries among payors are the continued escalation of healthcare costs and a shortage of clinical resources. Some respondents also express concern that large incumbents are too entrenched in existing systems to innovate, citing their “slowness to respond to technology and reluctance to change old models.”

These findings mirror key takeaways from a series of HPIR Roundtable events in late 2023 that brought together leaders from more than a dozen plans. Managing high claims costs is a top priority, along with addressing member engagement and mental health needs. And while plans voiced concern about the inherent challenges of AI in healthcare, they see significant potential for AI to drive value.

“It’s promising to see optimism from health plans around the potential for technology to create efficiencies and for disruptive payment models to address cost and access challenges,” says Ryan Engle, a partner at TT Capital Partners. “These types of advances rarely happen quickly or easily, but we are already seeing numerous examples across the industry – from automation technology that speeds healthcare billing and payment cycles to promising shifts to value-based care in sectors that are especially ripe for improvement, such as women’s health and high-needs populations.”

Providers and Systems: Navigating Financial Pressures

On the other end of the optimism spectrum from healthcare plans, providers are less confident about the future of healthcare, with only one-third saying they’re somewhat optimistic. The most common concerns among providers are financial. As one provider succinctly states, “Costs are outpacing revenue, without any ability to close the gap.” In order to address the issue, systems need consistent and (ideally) growing streams of revenue, as shifts in patient mix continue to create financial pressures.

Indeed, during last fall’s Provider Health Innovation Roundtable (PHIR) events, many providers mentioned they are taking a proactive approach to revenue diversification through strategies such as added investment in research and development, unique partnerships, and more diverse investments.

Like other groups in healthcare, providers are excited about advancements to augment care delivery and payment models, and they look to innovators to help drive new standards for both. Notes one respondent, “There is growing awareness, excitement, and commitment to address health equity and access concerns.” Some respondents want to ensure that industry consolidation doesn’t stifle innovation for healthcare systems and plans. “Consolidation [can] result in monopolistic and less innovative behavior,” says one respondent.

Finally, providers continue to face another major challenge in the form of workforce shortages. The Bureau of Labor Statistics forecasts a U.S. shortage of 195,400 nurses by 2031 and shortages of up to 124,000 physicians in the next 12 years.

“While provider and health system leaders are optimistic about recent healthcare innovations, that optimism is largely overshadowed by the unprecedented pressures they are facing. They are working to mitigate rising costs, drive new revenue, and address the historic workforce shortages within healthcare,” said Shelby Barker, group leader for Provider Health Innovation Roundtable (PHIR), a World 50 community.

Employers: Innovation at What Cost?

The survey responses among employers were almost evenly split, with 49% saying they’re somewhat optimistic about the future of healthcare. Of the 51% who say they are pessimistic, the majority of those indicate they are only somewhat pessimistic.

Many employers are excited about new treatments and therapies, but they also cite rising costs as a common concern, especially pharmacy and treatment costs. One survey responded notes, “The ever-increasing introduction of costly care without significant outcome improvements makes me concerned that U.S. healthcare will become increasingly expensive.” Another adds, “New medical findings, effective new medications, and more disease awareness will greatly improve quality of life but also come with a huge price tag.” This mirrors the sentiment from last fall’s Employer Health Innovation Roundtable events — employers cited cost containment as their No. 2 priority. Pharmacy costs were No. 6, up significantly from No. 13 the previous spring.

According to Mercer, employers are facing the largest annual increase in healthcare costs in a decade, and there is fear that cost pressures could eventually affect various healthcare programs. “Significant healthcare headwinds put pressures on budgets, which could result in program cuts,” says one survey respondent.

Employers want more accountability and pricing transparency and express interest in disruptive models that promise more of both. And they say government regulatory and compliance requirements can pose a challenge because of the administrative burden; some survey respondents share specific concerns about state regulations that challenge the ERISA preemption.

“Employers are looking for cost-effective ways to address their employees’ diverse and growing healthcare needs, so naturally they’re eager to hear of new treatments and therapies, but increasingly they worry that the cost of such innovation is unsustainable,” said Jeannette Abbott, group leader for Employer Health Innovation Roundtable (EHIR), a World 50 community.

Innovators: Exceedingly Optimistic by Comparison

Looking back at last year’s survey of healthcare innovators, primarily early and growth-stage solution providers, 85% of participants said they were optimistic about the future of healthcare, including 22% who were very optimistic.

“Many of the innovators we surveyed are addressing known gaps in the healthcare industry, which is an exciting prospect that breeds both opportunity and optimism,” TT Capital Partner’s Engle says. “Still, despite the overriding optimism among these innovators, they too expressed concern about the financial pressures facing the industry and the potential that tight margins and consolidation may slow the adoption of innovation.”

For payors, providers and employers, it’s a balancing act between the promise of clinical and payment model advancement and the reality of financial constraints. Innovation is seen as somewhat of a double-edged sword — it has the potential to positively impact the industry, but the cost and disruption could push many out of the market.

Methodology

The TTCP/HPIR survey was conducted in Q4 2023 with nearly 60 executives across healthcare payors, providers and employers. The innovator survey was conducted in mid-2023.

About TT Capital Partners

TT Capital Partners (TTCP) is a sector specialist that provides capital, expertise and insight to healthcare technology and services companies that have the potential to become market leaders. With its exclusive focus on healthcare, extensive industry network, and deep investing and operating experience, TTCP has invested in some of the most high-growth businesses that are innovating and disrupting how healthcare is delivered, managed and consumed. Learn more at www.TTCapitalPartners.com.

About World 50 Group

As an invitation-only, private community for CEOs, boards, C-suite officers and executives from Global 2000 organizations, leaders of the world’s most respected companies join World 50 Group to learn from one another, exchange ideas, navigate complex challenges, and evolve as leaders. World 50 members are at the forefront of transformation, leading organizations with a total market cap exceeding US$34 trillion and more than 37 million employees worldwide.

In partnership with World 50, EHIR, HPIR and PHIR are member communities for leaders charged with evaluating and driving tech investment. The group creates a trusted peer community and innovation accelerator that fosters connections among forward-thinking leaders, their organizations, and cutting-edge solutions. The platform is designed by the members to advise each other in an environment that is 100% peer-level and confidential. Learn more at www.ehir.com.